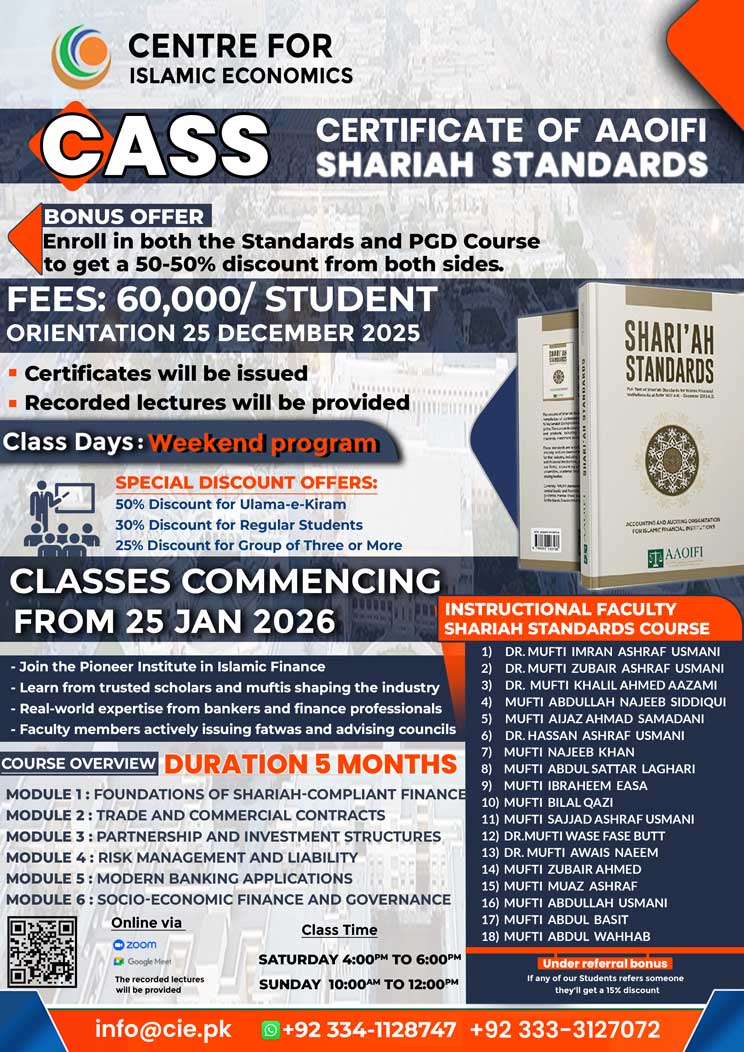

Certificate of AAOIFI Shariah Standards

CERTIFICATE OF AAOIFI SHARIAH STANDARDS

(Based on AAOIFI Guidelines)

5 Months Weekend Certification

HELD UNDER THE ADMIRABLE ADMINISTRATION OF

SHEIKH-UL-ISLAM MUFTI TAQI USMANI

WHO IS AN ESSENCE FOR THE WHOLE MUSLIM WORLD.

COURSE OVERVIEW

This course provides a comprehensive understanding of the Shariah standards that govern Islamic financial institutions, as developed by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI). It equips learners with the knowledge to analyze, apply, and evaluate Islamic financial instruments, contracts, and governance structures in alignment with Shariah principles.

Module 1 : Foundations of Shariah-Compliant Finance

Module 2 : Trade and Commercial Contracts

Module 3 : Partnership and Investment Structures

Module 4 : Risk Management and Liability

Module 5 : Modern Banking Applications

Module 6 : Socio-Economic Finance and Governance

LEARNING OUTCOMES

- Understand and interpret AAOIFI Shariah Standards across major Islamic financial products.

- Evaluate the Shariah compliance of financial contracts and banking operations.

- Apply ethical, legal, and governance principles in Islamic financial decision-making.

- Analyze risk, liability, and contemporary issues in Islamic financial institutions.

- Design and review Shariah-compliant financial instruments for modern markets.

RECOMMENDED AUDIENCE

- Shariah Scholars and Advisors

- Islamic Bankers and Finance Professionals

- Compliance and Audit Officers

- Students of Islamic Banking, Finance, or Law

Instructional Faculty (Shariah Standards Course)

- Mufti Imran Ashraf Usmani

- Mufti Zubair Ashraf Usmani

- Mufti Khalil Ahmed Aazami

- Mufti Abdullah Najeeb Siddiqui

- Mufti Aijaz Ahmad Samadani

- Hassan Ashraf Usmani

- MUfti Najeeb Khan

- Mufti Abdul Sattar Laghari

- Mufti Ibraheem Easa

- Mufti Bilal Qazi

- Mufti Sajjad Ashraf Usmani

- Mufti wase Fase butt

- Mufti Awais Naeem

- Mufti Zubair Ahmed

- Mufti Muaz Ashraf

- Mufti Abdullah Usmani

- Mufti Abdul Basit

- Mufti Abdul wahhab

- Join the Pioneer Institute in Islamic Finance

- Learn from trusted scholars and muftis shaping the industry

- Real-world expertise from bankers and finance professionals

- Faculty members actively issuing fatwas and advising councils

Bonus Offer

- Enroll in both the Standards and PGD Course

- To get a 50-50% discount from both sides

Special Discount Offers:

- 50% Discount for Ulama-e-Kiram

- 30% Discount for Regular Students

- 25% Discount for Group of Three or More

EMAIL: info@cie.com.pk